Tplink Mikrotik Equivalent

Here’s a simplified comparison table for TP-Link smart/managed switches and their closest MikroTik equivalents on Lazada Philippines.

| TP-Link Model & Link | Description (Ports, PoE Budget, Layer Support) | Lazada Price | MikroTik Equivalent & Link | Lazada Price |

|---|---|---|---|---|

| TL-SG3424 | 24-Port Gigabit Managed Switch (No PoE, Layer 2) | ₱8,900 | CSS326-24G-2S+RM | ₱10,049 |

| TL-SG2210MP | 10-Port Gigabit Smart Switch (8 PoE+, 150W, Layer 2+) | ₱10,990 | CRS112-8P-4S-IN | ₱12,359 |

| TL-SG1024DE | 24-Port Gigabit Easy Smart (No PoE, Layer 2) | ₱4,000 | CSS326-24G-2S+RM | ₱10,049 |

| TL-SG108PE | 8-Port Gigabit Easy Smart (4 PoE+, 55W, Layer 2) | ₱4,295 | RB260GSP | ₱3,950 |

| TL-SG3428 | 24-Port Gigabit Managed (No PoE, Layer 2+) | ₱17,999 | CRS326-24G-2S+RM | ₱10,049 |

| TL-SG2218 | 16-Port Gigabit Smart (No PoE, Layer 2+) | ₱8,299 | CSS318-16G-2S+IN | ₱8,699 |

Footnotes:

- Verify MikroTik specifications (Layer support, PoE wattage, and uplink ports) before procurement; listings can vary slightly by seller.

- Prices are indicative; check Lazada for current rates.

- MikroTik CSS series uses SwitchOS, while CRS supports both RouterOS and SwitchOS for flexible management.

Here’s a simplified TP-Link vs MikroTik comparison table with PoE and Layer support embedded in each description.

| TP-Link Model & Link | Description (Ports, PoE Budget, Layer Support) | Lazada Price | MikroTik Equivalent & Link | Lazada Price |

|---|---|---|---|---|

| TL-SG3424 | 24-Port Gigabit Managed Switch (No PoE, Layer 2) | ₱8,900 | CSS326-24G-2S+RM | ₱10,049 |

| TL-SG2210MP | 10-Port Gigabit Smart Switch (8 PoE+, 150W, Layer 2+) | ₱10,990 | CRS112-8P-4S-IN | ₱12,359 |

| TL-SG1024DE | 24-Port Gigabit Easy Smart (No PoE, Layer 2) | ₱4,000 | CSS326-24G-2S+RM | ₱10,049 |

| TL-SG108PE | 8-Port Gigabit Easy Smart (4 PoE+, 55W, Layer 2) | ₱4,295 | RB260GSP | ₱3,950 |

| TL-SG3428 | 24-Port Gigabit Managed (No PoE, Layer 2+) | ₱17,999 | CRS326-24G-2S+RM | ₱10,049 |

| TL-SG2218 | 16-Port Gigabit Smart (No PoE, Layer 2+) | ₱8,299 | CSS318-16G-2S+IN | ₱8,699 |

Footnotes: - MikroTik specifications (Layer level, PoE wattage, SFP count) should be verified upon procurement as listings occasionally vary by seller. - Prices fluctuate; verify before purchase. - Both series offer managed capabilities suitable for SMB and enterprise setups transitioning away from TP-Link ecosystems.

China (TP-Link) Alternatives in Network Equipment

Context

China-based brands like TP-Link have dominated the low- to mid-tier networking market for years. Their strong price-to-performance ratio, extensive distribution (through VST-ECS in the Philippines), and mature supply chains made them a default choice for many integrators. However, growing concerns over supply chain dependency, firmware transparency, and data sovereignty are pushing integrators and IT managers to explore non-China alternatives.

1. Japan: The Exit of NEC and the Void Left Behind

- NEC’s Exit (2024): NEC formally exited the network hardware market segment outside of its enterprise and telco contracts last year. Its managed switch line was phased out due to declining margins and internal restructuring to focus on core telecom and AI services.

- Impact: This left a vacuum in the mid-tier enterprise segment that Japan once filled with dependable, security-oriented equipment.

- Current Japanese Presence: Companies like Furukawa Electric and Hitachi Kokusai retain niche positions but not in the mass-market switch or router sectors. Japan remains strong in industrial automation networking (Ethernet/IP, Profinet, etc.), but not in general managed switches.

2. European Alternatives

a. MikroTik (Latvia)

- Positioning: The strongest European alternative to TP-Link in terms of affordability and feature set.

- Product Range: Switches (CSS and CRS series), routers, access points, and carrier-grade routing systems.

- Strengths: RouterOS flexibility, strong VLAN/QoS/Layer3-lite functions, and open configuration environment.

- Weaknesses: Steeper learning curve; smaller support network in the Philippines.

b. Ubiquiti (USA/European operations in Lithuania and Poland)

- Positioning: Hybrid US/EU company with European manufacturing.

- Product Range: UniFi switches, Dream Machine routers, and APs.

- Strengths: Ecosystem integration, solid software controller, strong community support.

- Weaknesses: Closed ecosystem, proprietary controller dependencies, and higher pricing.

c. D-Link (originally Taiwan, now with EU and SEA ops)

- Positioning: Transitional vendor between budget and enterprise space.

- Strengths: Widely available, established Philippine distribution.

- Weaknesses: Limited innovation; slower firmware updates.

3. Taiwan’s Offerings

a. Zyxel (Taiwan)

- Product Range: Managed switches, security gateways, and WiFi access points.

- Strengths: Strong SMB presence, cloud-managed Nebula platform, and robust after-sales support in Asia.

- Weaknesses: Slightly higher cost per port than TP-Link; Nebula licensing for some features.

b. QNAP (Taiwan)

- Product Range: Primarily NAS but offers high-performance managed switches (QSW series).

- Strengths: High-speed 2.5G/10G switching integrated with NAS environments.

- Weaknesses: Limited management features; geared toward small offices and media setups.

c. Edgecore Networks (Taiwan)

- Product Range: Enterprise and telco-grade managed switches, open networking hardware (ONIE, SONiC).

- Strengths: Open networking capability; used by hyperscalers (Facebook, Google).

- Weaknesses: Requires advanced network engineering knowledge; limited retail availability.

4. South Korea’s Options

a. Dasan Zhone Solutions (DZS)

- Product Range: Managed switches, GPON/EPON access systems, and broadband access gear.

- Strengths: Industrial-grade reliability; active telco partnerships in SEA.

- Weaknesses: Higher price point; limited consumer and SMB presence.

b. HFR Networks

- Product Range: Metro Ethernet and 5G backhaul systems.

- Strengths: Strong in enterprise-grade and telco deployments.

- Weaknesses: Minimal SMB presence; not cost-competitive for general IT infrastructure.

5. Distribution & Supply Chain Notes

- VST-ECS Lock-In: Many mainstream brands (TP-Link, D-Link, Ubiquiti, Hikvision) in the Philippines are distributed through VST-ECS, creating a bottleneck and potential conflict of interest for integrators seeking vendor-neutral sourcing.

- Alternative Channels: European and Taiwanese brands (MikroTik, Zyxel, Edgecore) are increasingly available through independent online retailers or direct procurement via EU warehouses.

6. Summary: Strategic Direction for Migration

| Region | Brand | Market Position | Pros | Cons |

|---|---|---|---|---|

| Europe | MikroTik | Affordable Enterprise | High configurability, open OS | Steep learning curve |

| Europe/US | Ubiquiti | Ecosystem-Driven | Integrated UI, wide support | Proprietary control, cost |

| Taiwan | Zyxel | SMB/Enterprise Hybrid | Nebula Cloud Mgmt, reliable | Subscription overhead |

| Taiwan | Edgecore | Enterprise/Open Networking | SONiC/ONIE support | Requires network expertise |

| South Korea | DZS | Telco/Industrial | Robust hardware | Expensive, limited SMB support |

Conclusion:

Migrating away from TP-Link and other China-based brands means adopting a mixed-vendor European and Taiwanese stack. MikroTik offers the most practical step for early migration due to its affordability and feature parity, while Zyxel and Edgecore can be integrated gradually for higher-end deployments. Japan’s absence from this market segment underscores the strategic opportunity for EU and Taiwan to fill the reliability gap with open, standards-based hardware.

MikroTik Wireless Devices Overview

| Image | Model & Link | Description | Price (PHP, ₱80/USD) |

|---|---|---|---|

|

Audience | Tri-band mesh WiFi (2.4 GHz + dual 5 GHz), RouterOS powered, PoE-in, ideal for large homes or offices. | ₱13,520 |

|

hAP ax³ | WiFi 6 router, dual-band 2.4 GHz + 5 GHz, quad-core ARM CPU, 1 GB RAM, 5× Gigabit Ethernet. | ₱14,320 (US $179) |

|

cAP ax | Ceiling-mounted dual-band WiFi 6 AP, designed for enterprise or campus mesh networks, PoE-in supported. | ₱9,520 (US $119) |

|

Chateau 5G | Dual-band WiFi 5 router with built-in 5G NR modem, 5× Gigabit ports, LTE/5G WAN redundancy, ideal for offices or mobile setups. | ₱36,000 (US $450) |

|

Chateau LTE12 | Dual-band WiFi 5 router with CAT12 LTE modem, ideal for areas with limited wired internet access. | ₱16,800 (US $210) |

|

LHG LTE6 Kit | Outdoor LTE CPE with 17 dBi antenna, long-range rural connectivity, PoE-in support, single Ethernet port. | ₱9,600 (US $120) |

|

wAP ac | Weatherproof dual-band (2.4 GHz + 5 GHz) access point for outdoor installations, compact form factor. | ₱5,360 (US $67) |

|

LDF LTE6 Kit | Outdoor LTE CPE designed to fit standard satellite dishes, increasing range for remote connectivity. | ₱8,000 (US $100) |

|

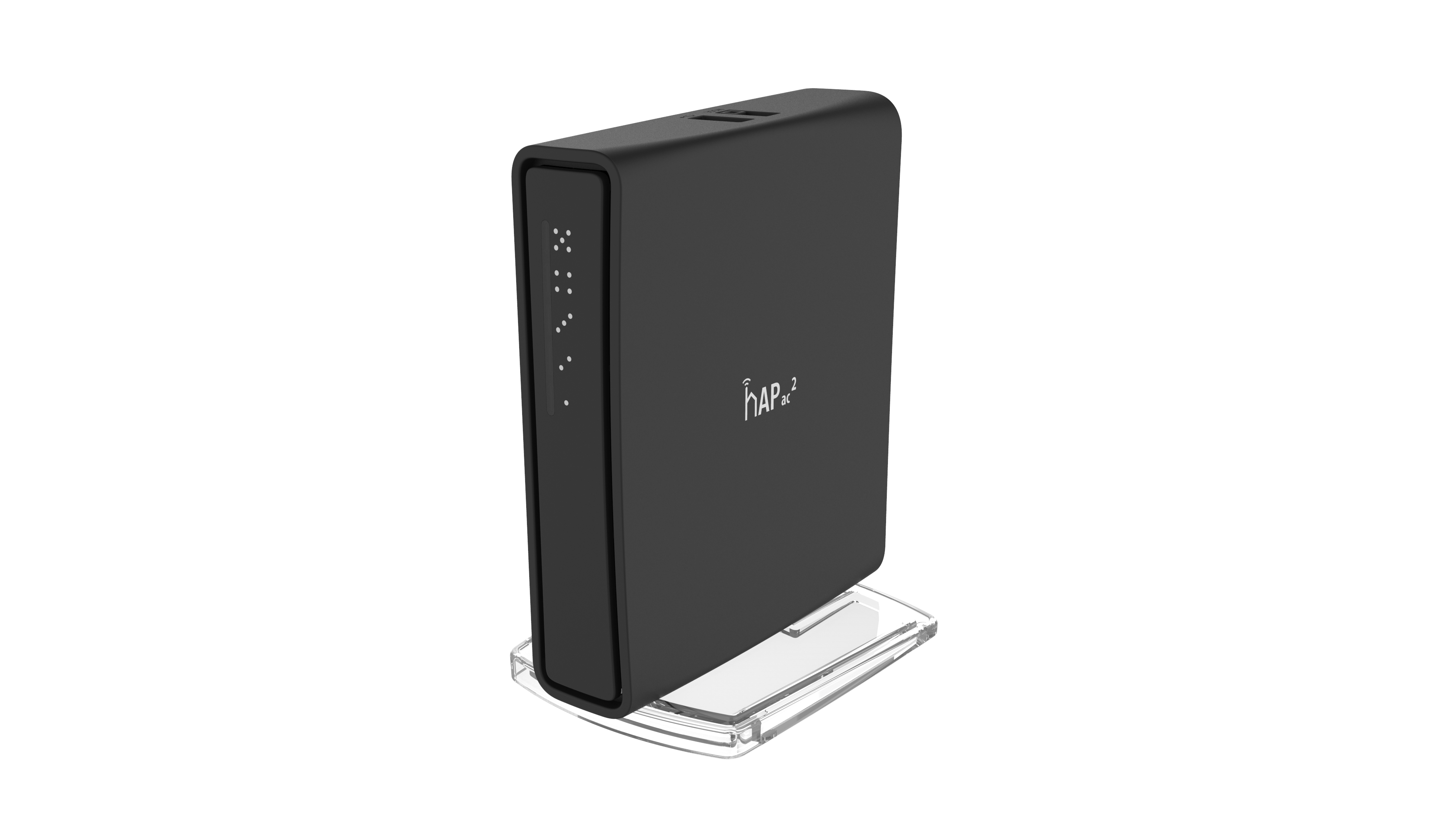

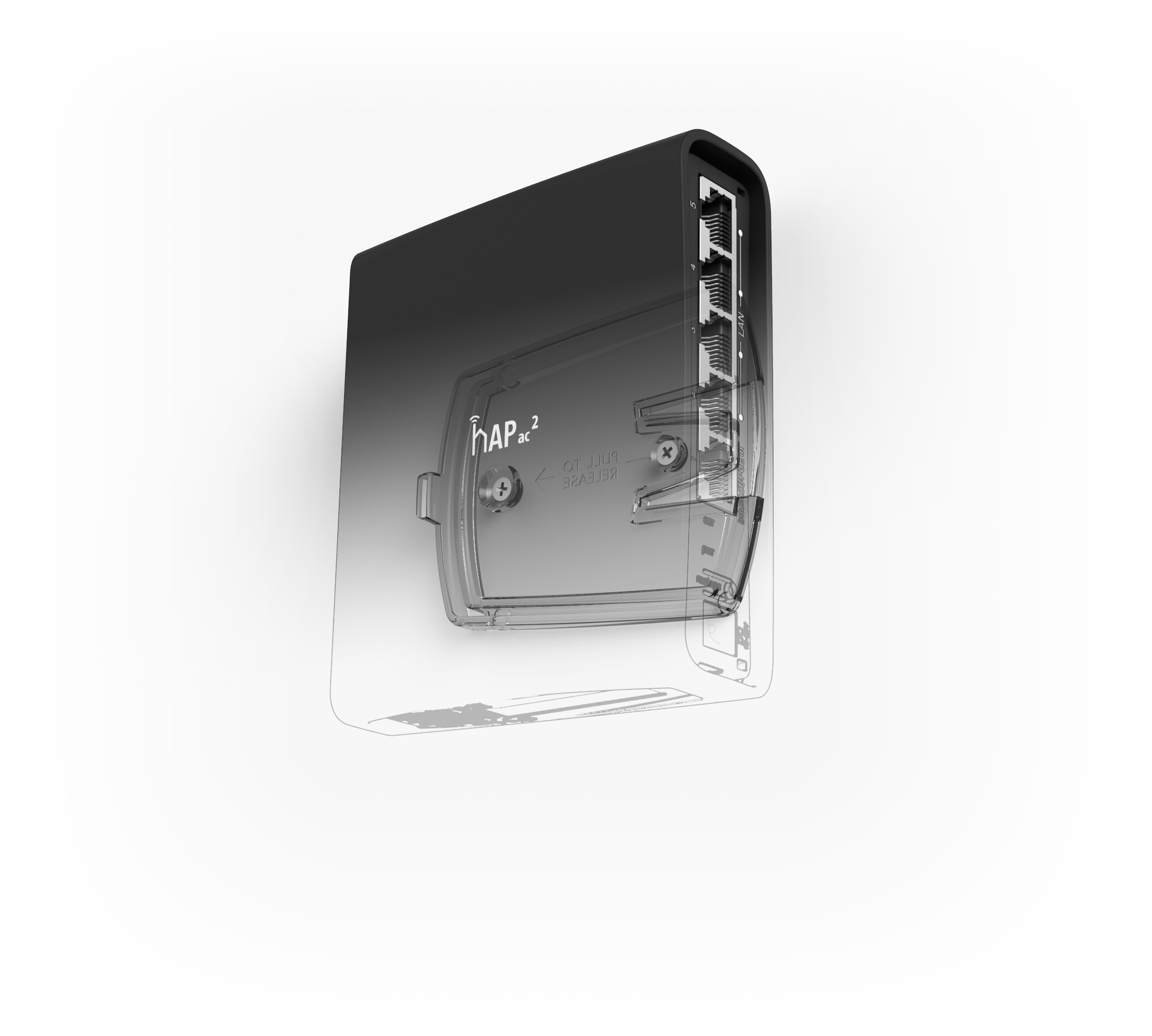

hAP ax² | Compact WiFi 6 router, dual-band, 4× Gigabit ports, optimized for small offices and home networks. | ₱9,520 (US $119) |

|

wAP ax (wAPG‑5HaxD2HaxD) | Weatherproof dual-band WiFi 6 access point with 2× Gigabit Ethernet, PoE‑in and DC jack, RouterOS v7, ideal for indoor/outdoor use. Available stock via United Plexus. | ₱5,250 (VAT INC) |

|

cAP ax (RbcAPGi‑5HaxD2HaxD) | Ceiling‑mount WiFi 6 access point with PoE‑in and PoE‑out, 1 GB RAM, quad‑core CPU, optimized for enterprise deployment. ETA mid‑Nov via United Plexus. | ₱7,600 (VAT INC) |

Summary Notes: - Prices converted at ₱80 per USD, unless otherwise noted as VAT INC. - Models from United Plexus: wAP ax and cAP ax (current stock and mid‑Nov arrival respectively). - Most models support RouterOS v7 and PoE‑in for flexible deployment. - WiFi 6 models (hAP ax², hAP ax³, cAP ax, wAP ax) are recommended for future‑proof installations. - LTE/5G models (Chateau series, LHG LTE6, LDF LTE6) provide strong options for off‑grid or rural connectivity.